“Socially responsible investing” (SRI) describes any investment strategy which incorporates environmental, social and governance criteria alongside financial analysis when making investment decisions.

Current donations

LifeMatters Foundation

www.lifemattersfoundation.org

Donations in previous years

The Roger Federer Foundation

www.rogerfedererfoundation.org/en/home/

Médecins sans Frontières

www.msf.org/en/country/switzerland

Sozialwerk Pfarrer Sieber –

www.swsieber.ch

Reprieve

www.reprieve.org.uk

ESG factors in our investment process

An ever increasing proportion of the funds we select take environmental, social and governance (‘ESG’) factors into active consideration as part of the investment process. In addition your shareholder voting rights are now often used to foster best practice. In the management of the share portfolios ESG factors, including the diversity of boards and management, are an important part of the quantitative “scoring system” we use for stock selection.

Incorporating individual client preferences

Certain clients request the exclusion of specific securities or industry sectors which do not fit with their personal value system. ISGAM has always accepted such requests and incorporates them into the relevant portfolio strategies for that client.

Proactive promotion of socially responsible investments

ISGAM has also proactively offered certain investments which it considers to be socially responsible. A number of clients have incorporated these into their portfolios. These include particular thematic investment funds (such as clean water and preventing or mitigating climate change) and investments which are specifically intended to have a positive social impact (micro finance, where money is lent to many small scale entrepreneurs in developing countries).

Investing in a pre-defined socially responsible strategy

For amounts starting from € 150,000, £150,000 or USD 150,000 ISGAM constructs a strategy including equities and fixed interest investments entirely in the socially responsible fields outlined above. This strategy can either constitute one of the building blocks (or “models”) upon which the portfolio is constructed or it can be applied to a whole portfolio, on the client’s specific instruction.

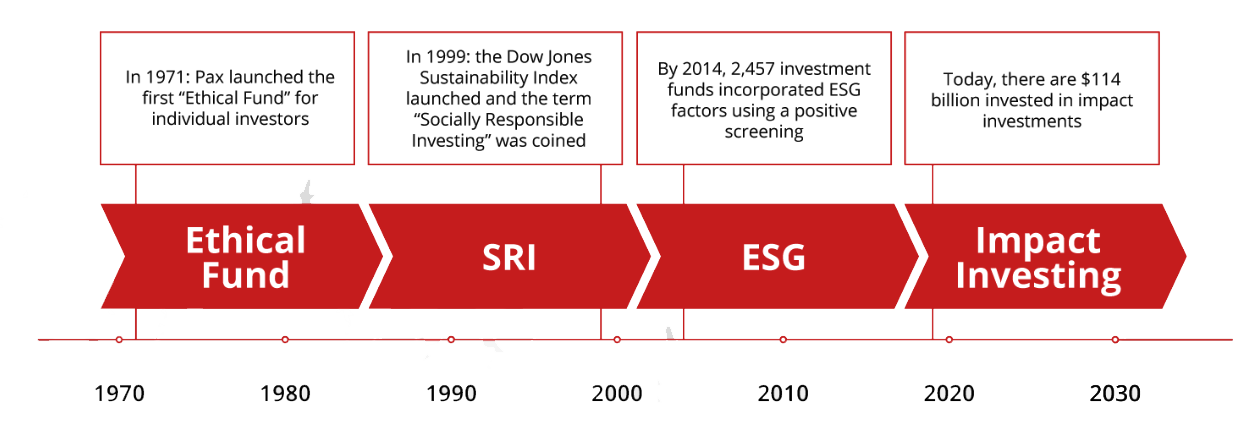

“Socially responsible investing” (SRI) describes any investment strategy which incorporates environmental, social and governance criteria alongside financial analysis when making investment decisions.

A sub-set of SRI, the main focus of “Impact investing” is on the positive impact of the investments chosen – an even more activist approach.

“Sustainable investment” is another term used for socially responsible investing

“ESG investing” is investing where environmental, social and governance factors are considered alongside financial factors in the investment decision making process.

“Ethical investing” refers to the practice of using one’s ethical principles as the primary filter for the selection of securities investing. Ethical investing depends on an investor’s views, and for that reason is subjective. So for some people “ethical” means excluding tobacco and guns, for others it means excluding alcohol and pornography.

An investor who owns shares in any company is entitled to attend the annual general meeting of the company, to ask questions of the directors and to vote at that meeting.

Managers of SRI and ESG funds use this power on behalf of their investors to have a positive impact on company policy by voting in a certain way and by actively engaging with management.