In the eye of a perfect storm

At the start of the year, it was clear that interest rates were set to rise as the world was emerging from COVID related lock downs and recession.

In anticipation of this new, rising interest rate regime, we had, in the final quarter of 2021, shifted to an underweight position in bonds, and cut our previously overweight equity allocation to neutral.

We had added to the “Alternatives” section of the portfolios. At that time the rise in interest rates, as signalled by Central Banks, was expected to be measured and gradual.

Also, economic growth was expected to remain strong as the world emerged from COVID lock downs.

Consumers were flush with unspent savings, and keen to resume their normal lives including travel. Meanwhile, COVID-related supply chain issues were expected to ease, relieving the upward pressure on inflation.

Russia’s war on Ukraine disrupted this benign scenario, with its stagflation effects. Next to that, China began implementing repeated lock downs in major cities in pursuit of its “zero covid” policy, prolonging supply chain bottlenecks and dampening global growth further.

In addition, there have been outbreaks of Avian flu in the US and parts of Europe, which, coupled with severe droughts in different parts of the world, exacerbate the food scarcity and food inflation brought on by the ongoing war in the “breadbasket of the world”, Ukraine.

In other words, the global economy is finding itself in the eye of a perfect storm, where central bankers have been scrambling to catch up with the current realities and transition from supporting growth to combatting the highest inflation we have experienced in decades.

US Headline Inflation (CPI), Core Inflation (PCE) and Wage Growth (ECI) are Highest in Decades

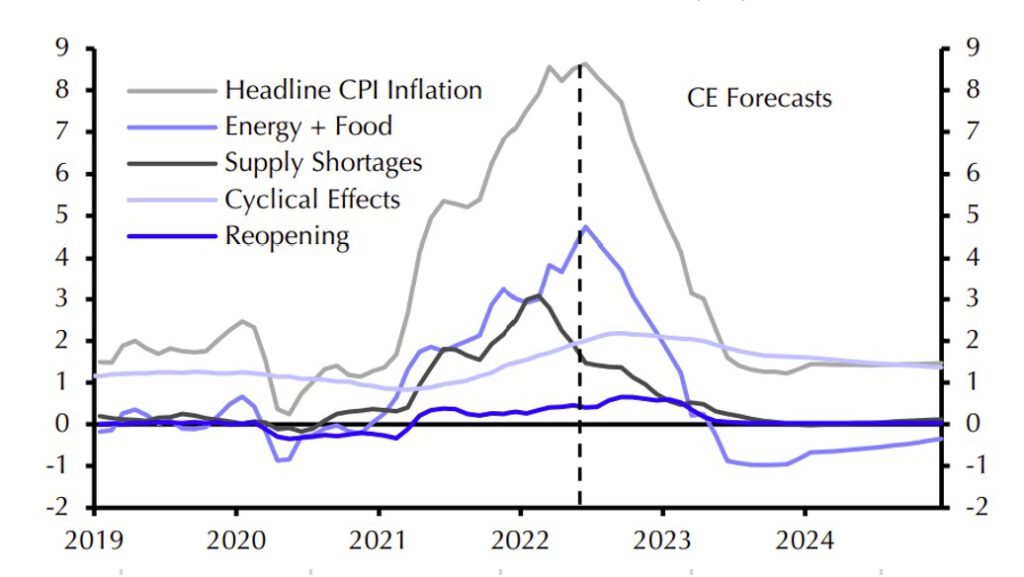

Central Banks have little control over food and energy inflation, as these are caused by lack of supply rather than red-hot demand. Also, they are gradually expected to disappear from the year-on-year inflation statistics. Central Banks do however worry about high inflation expectations becoming embedded in higher wage demands, as this would be a more lasting and pernicious form of inflation; like the price-wage spiral which economies suffered in the 1970’s.

This spiral was only successfully broken in the 1980’s, after a period of very high interest rates which effectively pushed the economy into a deep recession.

It is for this reason (to get ahead of inflation emphatically before expectations of permanently high inflation become embedded in wage and price setting) that Central Banks have suddenly become so much more hawkish.

All in all, we should be close to a peak in inflation.

Despite this, Central Banks will push ahead with their tightening plans to firmly get inflation back under control.

Meanwhile the tightening in financial conditions (which has already been considerable) coupled with uncertainty around company earnings will probably keep markets volatile over the summer.

Expected forward path of CPI inflation in the US, split over its components

Excerpt from ISGAM’S Manager’s Report for the Second Quarter of 2022, published 30th of June 2022.

By Marianne Rameau, ASIP, Portfolio Management Team,

ISGAM AG Contact: enquiry@isgam.ch

This document is prepared for educational and informational purposes ONLY, by ISGAM AG. Please click here for the important information. It is not intended, nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. The information provided is not to be treated as advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. Past performance is not a reliable indicator of future performance.